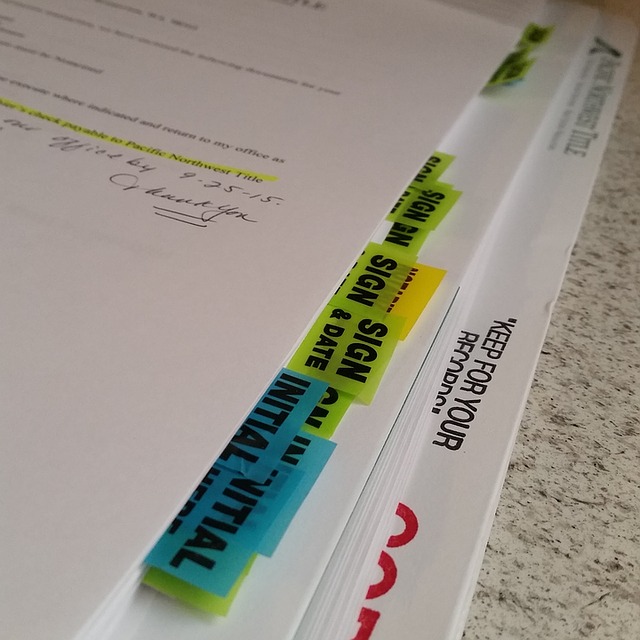

Purchasing an RV can be stressful! In fact, other than purchasing a home, it’s probably one of the biggest personal purchases you’ll ever make. When you consider that some RVs even cost as much as homes, it’s no wonder you may approach the transaction with some trepidation.

Take a deep breath. With a little research, you can go into your purchase knowing that you have made sound financial decisions when buying your RV.

How to avoid bad RV Financing

The last thing you want to do when making such an expensive purchase is to find yourself saddled with a high-interest loan, or an RV that is much more than you had anticipated paying for. That’s why it’s important to sit down before you even begin looking at motorhomes and figure a few things out.

How much can you afford? What monthly payment can you actually make? What do you need in an RV, and are your requirements realistic for your budget? If you’re not sure what to expect to spend on an RV, do some searching online before you go. Look up the manufacturer’s price for models you’re interested in. Check Craig’s List and other forums – not to buy, but just to get an idea what people are asking for these vehicles. Talk to people who own RVs to see if you can get a basic understanding of the costs that go along with them.

RV & Motorhome Financing Mistakes

There are some common mistakes that can lead to bad RV financing. In fact, a lot of times the mistakes that lead to bad financing for RVs are often the same mistakes that lead to bad financial decisions with any large purchase. The good news is that since these mistakes are the same across the board, you can use the same principles to avoid them.

1.) Avoid impulse buys

Remember the work you did above, where you wrote down what you wanted in an RV and how much you could afford? That was to keep you from an impulse buy. If you find an RV that has well above what you need in a rig, and costs well above what you’ve budgeted – move on!

When you are planning your purchase, also remember to account for the extra expenses that come with owning an RV. Along with monthly payments on your vehicle, you’ll need to have money for routine maintenance, insurance, campsite fees, gas, other travel costs, and storage if you don’t have your own space to keep it. Will you want some money for bedding or dishes or decor? Does the RV you’re looking at need any work and can you afford that? Be brutally realistic about your budget and don’t brush off any costs thinking you’ll figure out how to afford them later. It’s much better to wait until you have the funds in place than to purchase something without a long-term plan to pay for it.

2.) Have a down payment

You get a much better interest rate on a loan if you can put some money down upfront. The amount of money you’ll need to put down varies depending on your lender, but 10-20% is typical, and having 20% of the purchase price is ideal. Putting down more money upfront will keep your monthly payments lower, and could get you a lower interest rate as well.

3.) Have a good credit score

This is one of those times a good credit score comes in handy. To put it bluntly, people with good credit get better loans. In fact, because an RV is a luxury and not a necessity, you’ll need an even higher credit score than the average person. You’ll ideally want a credit score of above 700 if you’re looking for an RV loan, and if you don’t have that yet, you may want to wait on purchasing an RV until you can get your score up. Work on paying your bills on time and lowering the rest of your debt, especially credit cards to boost your score before looking for RV financing.

4.) Consider used RVs

Unlike houses, vehicles, in general, depreciate from the moment you drive them off the lot. A used RV that is in great shape and is a good quality motorhome will likely cost much less than a brand-new one and you may never even know the difference. Or, the owner may have put upgrades or modifications making a used RV even better than a new one. Take the time to consider used RVs and to know what they are worth. You can try out used RVs and rent one right here on RVshare. It’s a great way to try out various motorhomes and trailers and see exactly what you want for your own vehicle. (But when you do go out to buy one, use our tips to avoid ending up with a lemon!)

5.) Don’t be afraid to negotiate

Just like when you buy a car, the price of an RV is almost always negotiable. Whether you’re buying a brand new vehicle or a used one, talk to the dealer or seller and see if you can work out a deal. This is where your research comes in! Know how much the vehicle is worth, and be able to make your case for why you’re haggling. You’ll be much more likely to get the price down if you can make a convincing argument.

6.) Shop around

Shop around for RVs of course, and see if the one you want is available elsewhere for less. But also shop around for your financing. It’s possible you won’t get the best interest rate and financing from the RV dealer, and you may want to check with your bank or another lender to see if you can get a better deal there.

How does RV Financing Work?

There are several RV financing options so you’ll want to do a little poking around. Depending on factors such as your credit score, job situation, and more, you may find that one loan works better for you than another. Here are several options:

1.) An RV loan

An RV loan is a secured loan using the RV you purchase as collateral. The bank owns the title of your RV until your loan is completely paid off, usually in 10-15 years.

2.) A home equity loan

A home equity loan uses your home as collateral rather than the RV. You need to have enough equity available in your home for this, so it will likely only work for you if you’ve been in your home for a while. Some people call a home equity loan a second mortgage, assuming you already have a mortgage on your home. Home equity loans typically have the best interest rate and repayment terms, often needing to be repaid in 10-15 years.

3.) A personal loan

Personal loans don’t require collateral, which means they usually have a higher interest rate and the repayment terms are shorter. Both lenders and borrowers tend to be wary of personal loans because the risk on both sides is greater. Usually, personal loans must be repaid in five years or less.

How to get an RV Loan when you have bad credit?

If you do have bad credit, and you’re working on bringing it up but still want to buy an RV, you have a few options. You’ll want to start by making payments for all of your obligations on time, and watching your spending. You’ll also want to check your credit score, so you know exactly what you’re dealing with. You can get a free copy of your report from each of the three national reporting agencies once a year – Equifax, Experian, and TransUnion. Many banks and credit card companies also have programs where you can view your credit score as one of the perks of being a customer.

Begin paying down your credit cards as well. The lower your credit card balances, the better your credit will be. Don’t make any other major moves regarding credit cards – don’t open any new accounts, but also don’t close any accounts. If you have some accounts with a zero balance, it actually improves your credit score because the amount of credit available to you versus the credit you have used improves.

You’ll also want to start saving for a down payment. The more money you can come into the transaction with up front, the more favorable your loan will be.

Since you do have poor credit, you’ll also want to set aside more time to shop for a loan – perhaps two months or more. Check with your bank, local credit unions, RV dealers, and look around online to see what options are available to you. As you look for a loan, keep your inquiries within a 14-day span. Drawn-out loan inquiries can make it look like you’re trying to take out several loans at once, which can negatively impact your credit score. A short time period with several inquiries is more likely to be recognized as applications for one loan.

Finally, if you do get a high-interest RV loan with bad credit, plan on continuing to work on your credit and make those loan payments on-time. If you can improve your score over the next year or so, you may be able to refinance your loan at a much lower interest rate.

Which lenders offer RV loans to people with bad credit?

As you do your research and begin searching for poor credit RV loans, you may want to consider one of the following lenders.

My Financing USA has a whole division that specializes in bad credit RV loans. Past bankruptcies and credit scores as low as 550 are okay, although you are required to provide a 10% down payment. You may pay up to 24.99% APR with them. Another online lender with bad-credit RV loans is Southeast Financial. A solid employment history, credit score of 550 and up, and minimum annual income of $20,000 are all going to help you in getting a loan with Southeast.

If you are a member of a credit union, that can also be a good option for a loan, possibly even a loan for RV financing with poor credit. If you’re not a member of a credit union, your bank may also be able to offer you financing.

Finally, dealerships are also an option for financing, even for those with bad credit, but they can be more expensive and have much higher interest rates or added fees that take you by surprise. They may also have much shorter repayment windows, leading to much higher payments every month. If possible, look into financing your loan elsewhere – you can always ask the dealer if they can beat it and you’ll know you’re getting the best deal.

When you are doing your research before deciding on your RV and finding financing for it, be sure to try some out. Renting an RV with RVshare is a great way to decide what you like and what you don’t in a motorhome, and can help you winnow down your list of needs and wants when you’re shopping. And frankly – it’s just plain fun! It’s not often research involves going on a vacation for a weekend or so. Have a good time, enjoy the RV you rent, and keep a list of the pros and cons of the vehicle to help when you’re shopping for your own.